Waterford is the most affordable City to buy or rent in Ireland

Right now it’s commonly said, “we are all in this together,” and yes we are in this together. However, we are in different boats.

As far as property goes in Ireland there are many different boats. What do I mean by this? In Ireland the average price for a house is €255,000. The average price in Dublin is €366,000.

In some areas of Dublin such as Dun Laoghaire – Rathdown area the highest median price is €530,000.

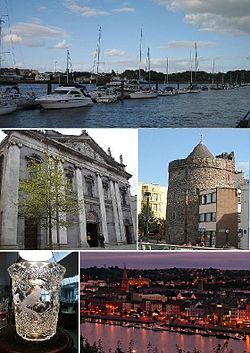

According to a national report Waterford is the most affordable City to buy or rent in Ireland. The average price for a house in Waterford is €197,000. (reference IPPI)(Irish Property Price index)

Waterford Rent Comparison

Rents average €300 less a month in Waterford compared to Cork, Limerick or Galway. Dublin rents are double the price of rents in Waterford. House prices are 51% lower in Waterford compared to Dublin City.

Ok, so I’ve told you about all the money you can save if you live in Waterford compared to the cost of living in Dublin, Cork, Limerick, and Galway.

Quality of life

What about quality of life? Right now, we’ve been in lockdown for two months. I for one have had a great opportunity to re-evaluate my quality of life as have most of us. The conclusion I have come to is that I am very lucky.

I live in An Rinn, outside Dungarvan in County Waterford. My new office is located upstairs in the house. I can see the sea from my window and I now realize I am extra lucky to have this beauty on my doorstep. Imagine before all this, I used to drive to Waterford City almost every day one hour to work and one hour home. Will I do that after lockdown? No, I won’t.

We are celebrating 23 years in business this month. I have a fantastic team and great systems so I’m lucky that I can work from home half of the time going forward. Before the lockdown, I had never sat upstairs and worked in my home. I never had the time to really and truly appreciate my surroundings.

What Waterford has to offer

I grew up on a farm in Crecora, Co Limerick more years ago than I’d care to mention. We had to drive at least 1.5 hours to get to the nearest beach. That’s one of the things I love most about Waterford. The beach’s in County Waterford that I love most, include; Woodstown, Clonea, Bunmahon, Ardmore, Tramore, and Dunmore East. According to Met Eireann, the Southeast which includes County Waterford gets the most sunshine in Ireland.

I haven’t even covered the beautiful mountains, coastline, and Waterford Greenway.

We carried out a poll on Facebook in the last week to ask people to vote on A) Do you love your home now more than ever and is it likely to be your forever home. Consistently 66% of people said yes and 34% went for B) and they definitely need to move.

Location, Location, Loctaion

Waterford City is 1.5 hours to Dublin, an easy drive as it’s motorway all the way. I believe that Waterford offers a great place to live with a better quality of life and lower house prices. Did you know childcare is 22% lower in Waterford compared to Dublin and Cork? Lots of people will be able to work from home more and so will no longer have to live near their place of work. If you are spending 3 hours commuting to work every day that’s pretty much 4 full weeks of your life lost to driving Monday to Friday.

I believe when restrictions are lifted people are going to be very cautious about who goes into their property. If you are selling and living in your home, will you want to know who is walking around your property? Virtual tours and property technology will help estate agents to do a better job of pre-qualifying prospective buyers. Buyers will need to be purchase ready.

Be mortgage ready!

That means if you need a mortgage then you will need to be mortgage approved in principle. It’s really important that you meet your broker or bank at least 6 months before you decide to buy. There are important things you will need to do to get ready. You will be required to have at least a 10% deposit (if you are a first-time buyer) and a bank statement to provide evidence that you have the payment capacity. This will be to demonstrate you have a track record in paying rent every month or that you have savings every month equivalent to meeting the mortgage repayments. This is the same principle for non first-time buyers, except you will need to have a 20% deposit.

Be purchase ready

Will you need to sell your home to move on? It will be really important and more so than ever that you are purchase ready. That might mean putting your house on the market and being ready to go when you find your forever home. It’s important you get ready to sell and are serious about moving when your agent finds a buyer that will pay a price that you are happy with. Of course it will be more important that your buyer is purchase ready and has their finances in order. If they have to sell a property that means you are in a chain and you will need to consider all of these factors when deciding whether to accept an offer. The highest price may not always be the way to go. The readiness and reliability of the buyer is something that needs to be considered seriously.

Get ‘your ducks in a row’

Agents are providing valuations online. If you are thinking of moving get your house valued. Get your ducks in a row and at least be armed with the information so you and your family can make informed choices.

I love this quote by Oprah Winfrey, “The biggest adventure you can take is to live the life of your dreams.”

Stay safe and take care.

Is mise le meas,

Regina Mangan